Reducing rental management costs

In this article, discover how rental property managers reduce their costs to save the equivalent of a full-time position, while simplifying their daily routines. Tools, methods, and clear projections included.

Property management fees refer to the amounts charged by a property manager or real estate agency to handle the day-to-day management of a rental property. Most often, these fees are expressed as a percentage of the rent excluding charges.

So, what exactly do these fees cover? And more importantly: how can you optimize them without compromising the quality of management? We break it all down for you, backed by real numbers.

Market range of property management fees

In 2024–2025, property management fees in the French market typically range from 6 to 10% (incl. VAT) of the rent collected (excluding charges), depending on the property's location, type, and the level of service provided.

What these fees typically include:

Day-to-day administrative management

- Rent and service charge collection

- Issuance of rent receipts and follow-ups as needed

- Annual rent review and adjustment based on the IRL index

- Tracking payments and management of potential arrears

- Payment of co-ownership charges on behalf of the landlord

A tool like Smovin can significantly simplify rental management. By automating routine tasks, it helps reduce human error and frees up time for higher-value activities.

Technical follow-up (excluding repair & maintenance costs)

- Organizing repairs and interventions when needed (plumbing, electricity, etc.)

- Managing property damage claims and coordinating with insurance providers

A tool like Urbest can significantly improve the management of intervention requests. By centralizing communication between tenants, property managers, and service providers, it helps reduce the risk of errors and enhances responsiveness.

Accounting and Tax Management

- Generation of an annual statement for property income tax reporting

- Assistance with tax filing based on the selected tax regime

Other fees that may or may not be included in these 6-10%

- Leasing (or re-leasing) fees: usually billed separately, equivalent to one month's rent including VAT, split equally between the tenant and the landlord, in accordance with the French ALUR tenancy law.

- Unpaid rent insurance (Garantie Loyers Impayés): if taken out through the agency, this typically costs 2% to 3% of the rent including VAT.

- Termination or account closure fees: occasionally charged at the end of the contract, depending on the agreed terms.

Example for a property rented at €1,000/month:

- Monthly rate excluding charges: 1 000 €

- Property management fees at 8% incl. VAT: 80 €/month, or 960 €/year

- Unpaid rent insurance (if subscribed) at 2.5%: 25 €/month, or 300 €/year

- Letting fee: one month’s rent incl. VAT shared between the landlord and the tenant => 500 € to the landlord

For a total annual cost of 1,760 €, excluding any repair or maintenance expenses.

Time, the central factor of profitability

To understand why digital tools have become essential in rental property management, it's important to analyze how much time a property manager can actually dedicate to a property while maintaining the profitability of their business.

Let’s assume a property manager charges 40 € per hour and receives 8% of the monthly rent for a property rented at 1,000 € per month.

This means that:

A property manager can only spend 2 hours per month managing this property (€80 / €40 per hour), otherwise, he would be working at a loss.

But how is this 2 hours actually spent?

This is what we will explore in the next section, by breaking down the typical tasks of a rental property manager.

Average time spent on each tasks

🧾 1. Rent collection & Management

Objective: 15–20 min/month

- Check rent payment, either directly in the bank account or through automated property management software

- Generate and send the rent receipt to the tenant (often automated but manually verified)

Estimated time: 10 to 15 minutes/month

🧮 2. Accounting and tax management

Objective: 5–10 min/month (yearly average)

- Monthly bookkeeping (preparing documents for tax reporting, checking the allocation between rent and charges etc.)

- Preparation of the annual landlord statement

Estimated time: 5 minutes/month (spread over the year)

📞 3. Tenant relations

Objective: 20–25 min/month

- Responding to questions about rent reviews or service charges

- Following up on minor issues or dispute (e.g., slow leak reported by phone)

Estimated time: 20 minutes/month

🛠️ 4. Technical follow-up and maintenance

Objective: 20–25 min/month

- Coordinate a plumber's intervention for urgent repairs

- Request quotes for minor works

Estimated time: 20 minutes/month (for non incidents month)

📤 5. Document management & legal compliance

Objective: 5–10 min/month

- Annual rent adjustment based on the IRL index (1x/year, spread over the year)

- Track the tenant’s insurance certificate or the energy performance certificate (DPE) upon renewal

Estimated time: 5–10 minutes/month

📆 6. Tenant turnover & new letting (occasional but time-intensive)

Objective: 0 min some months, over 2 hours in others (average over the year)

- Organize viewings for a new tenant

- Draft a new lease, perform move-in/out inspections

Estimated time: ~15 minutes/month

Now that we’ve reviewed the task breakdown performed by a rental property manager or agency, let’s compare the figures and highlight the positive impact of using digital tools like Smovin and Urbest.

Comparative table with vs. without the use of digital tools

Some substantial savings for the property manager: this table shows that the combined use of digital tools like Smovin and Urbest significantly reduces the time spent on each property.

- Time saved: 100 min – 67 min = 33 minutes/mois

- Cost avoided : 33 min × 40 €/h = 22 € saved/ month, per property

- Annual savings : 22 € × 12 months = 264 €/year, per property

On average, the combined use of Smovin and Urbest saves 33 minutes per property each month.

Thus, for a portfolio of 50 properties, the property manager would save €13,200/year in time, while maintaining its service quality, thanks to the automation and centralization offered by Smovin and the task management and tracking provided by Urbest.

Savings depending on your portfolio size

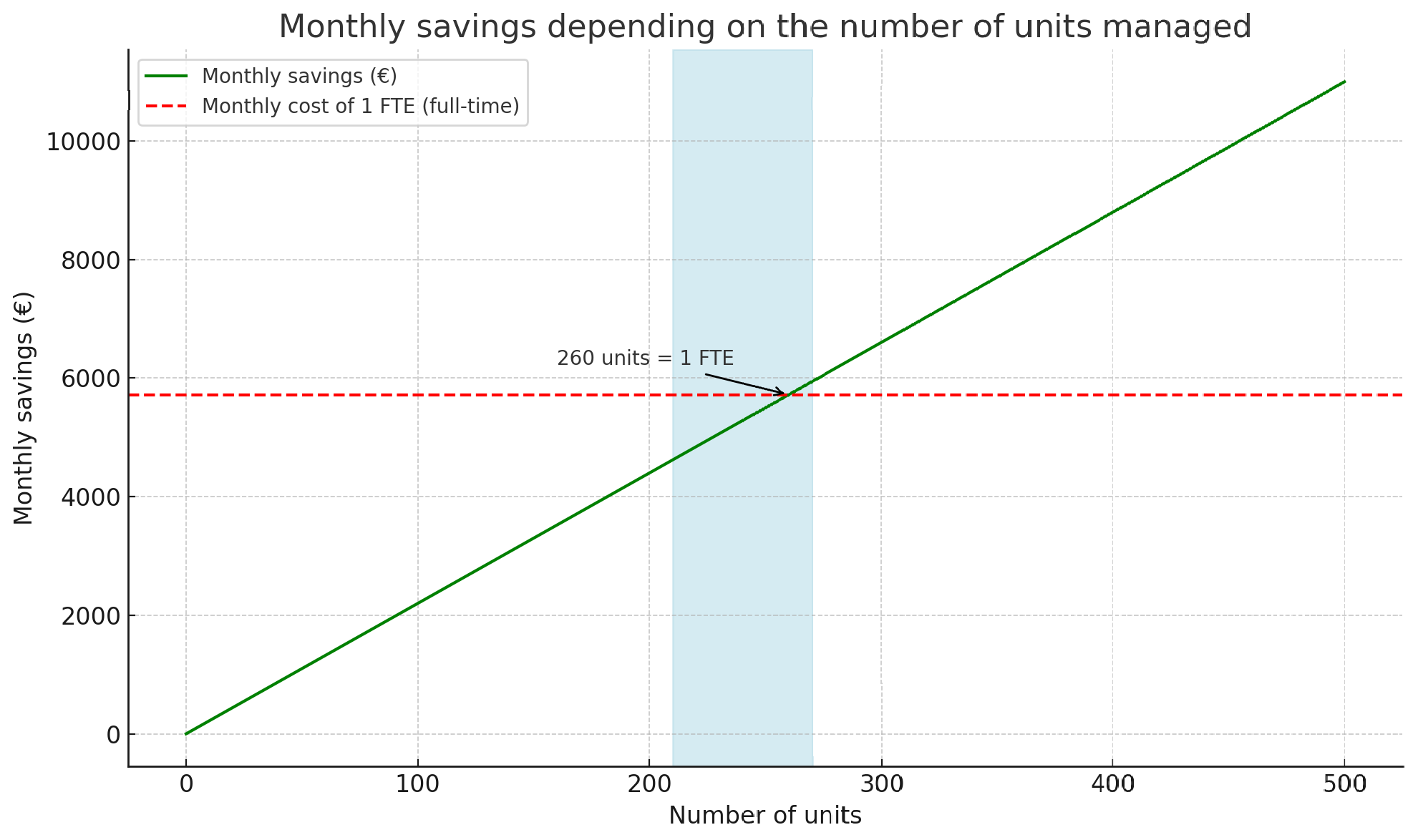

The savings generated by the combined use of Smovin and Urbest are equivalent to the monthly cost of a full-time employee once your portfolio reaches around 270 rental units.

Digital tools like Smovin and Urbest are no longer a luxury — they’re essential for optimizing rental property management. By automating time-consuming tasks, they enable property managers to improve efficiency while maintaining high service quality.

Savings become noticeable with just a few dozen properties and turn into a strategic advantage beyond 200 units. Even better, these solutions make your business scalable without increasing your workload.

👉 Find out how Smovin and Urbest can transform your day-to-day operations.